European Defence Fund and its impact on Czech industry

The Common Security and Defence Policy, which frames the efforts to create an EU defence identity, targets a wide range of actors and activities, entrusts the relevant competences to a number of institutions and uses a number of instruments, the parameters of which are regulated by an extensive set of documents, both conceptual and legislative. The aim is, among other things, to mobilise all available and acceptable resources for all parties and to use them as efficiently as possible. The European Defence Fund is part of this mosaic.

The proposal to establish a European Defence Fund (EDF) forms part of the European Defence Action Plan (and hence the comprehensive defence package) adopted in 2016. The need for such an instrument is justified by the inadequate level and quality of investment in the development and acquisition of future capabilities in the European defence industry environment, the very low level of cooperation between Member States in procurement, research and technological development, the persistence of a high level of fragmentation (the European Commission Communication states that there are 178 different weapon systems in Europe compared to 30 in the US), or the spending of unnecessarily high levels of taxpayer funds due to uncoordinated, duplicated or sub-optimal deployment of defence forces.

With the first funds earmarked for 2021, the EDF is becoming a milestone in the development of European defence, thanks to its unique set of conditions. For the first time, the European Commission is gaining significant competences in this area. Funding or co-funding from the common EU budget is made available for defence research and development. Moreover, applicants compete for grants, with the result that the guarantee of a return on national contributions to the European budget as a whole disappears.

In order to be able to properly set the terms of the calls for funds and manage them properly, the European Commission is first gaining experience by launching several test programmes. Following a €1.4 million pilot project in the field of defence research, in November 2016 the European Commission announced its intention to launch the Preparatory Action for Defence Research (PADR). This programme is still almost exclusively implemented through indirect management by the European Defence Agency. The total budget of €90 million is divided into three annual calls (€25 million in 2017, €40 million in 2018 and €25 million in 2019). A key condition for participation in the competition is that consortia must be made up of at least three entities from three different EU countries. The final PADR supports 23% of entities from France, 16% from Italy and 10% from Germany and Spain. From the Czech Republic, two entities out of two hundred are able to succeed in the calls, in the TALOS (Tactical Advanced Laser Optical System) and PRIVILEGE (PRIVacy and Homomorphic Encryption for Artificial IntElliGencE) projects.

Another test programme, this time focused on capability development, is the European Defence Industrial Development Programme (EDIDP), which is already directly managed by the European Commission. Under the Multiannual Financial Framework, a financial allocation of €500 million has been approved for EDIDP for 2019-2020. Studies, defence product designs, technologies, prototypes, certifications, etc. may qualify for support. In particular, priority is given to consortia projects involving SMEs. Again, another key condition is that projects must be carried out by a consortium of at least three entities established in three EU countries.

In total, 44 projects are supported under EDIDP. In terms of supported entities, again the largest number (20%) comes from France, 12% from Italy, 13% from Spain and 10% from Germany. From the Czech Republic, a total of five entities qualify for both years, under the PEONEER (Persistent Earth Observation for actioNable intElligence survEillance and Reconnaissance), JEY CUAS (Joint European sYstem for Countering Unmanned Aerial Systems), e-COLORSS (European COmmon LOng Range indirect fire Support System) and FIRES (Future Indirect fiRes European Solution) projects. The success rate of Czech entities is roughly one quarter (2019 figure).

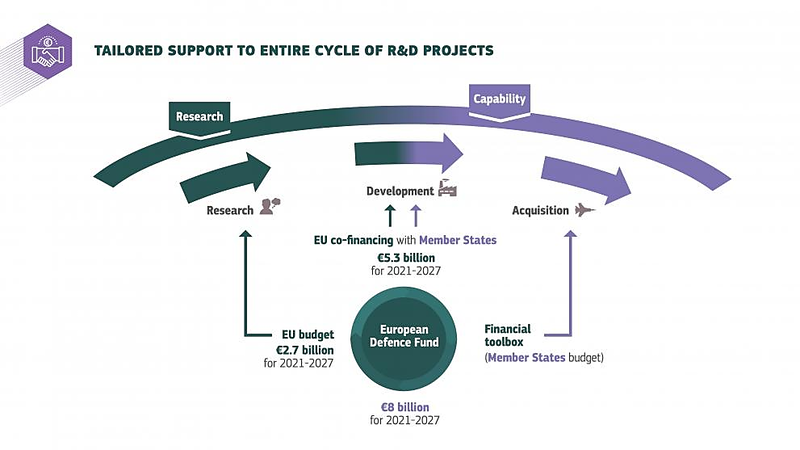

After testing, the European Commission is already launching the EDF itself. The EDF is set up for the period 2021-2027, so that the duration of the fund is aligned with the duration of the Multiannual Financial Framework 2021-2027. The overall objective of the EDF is to support the competitiveness, efficiency and innovation capacity of the EDTIB (European Defence Technological and Industrial Base), which in turn can contribute to the strategic autonomy and capability of the EU. The financial resources for the whole period amount to €7.95 billion, of which €2.65 billion is earmarked for research actions and €5.3 billion for development actions.

The Fund is implemented through annual work programmes which set out in detail the research topics and categories of actions to be supported. These categories and subsequent calls must be in line with EU defence priorities. The calls for proposals are open to applicants and a winning project is then selected from the submissions on a competitive basis. Again, projects must be carried out by consortia of at least three entities established in three EU countries. The research project shall be implemented and financed 100 % from the EU budget. This is not the case for development projects, where the support is between 20% and 80% of the eligible costs. At the same time, development projects need to demonstrate that at least two Member States or Associated Countries intend to acquire the final product or use the technology in a coordinated way.

Twenty participating entities from the Czech Republic

In total, 60 projects have been supported so far under the EDF in 2021 and 41 in 2022. The most successful applicants in both years combined came from France (14%), Italy (14%), Germany (12%) and Spain (12%). Almost twenty entities are participating in the selected consortia for the Czech Republic. These include large companies, SMEs and research and educational institutions from various sectors. However, the share of Czech participation in 2021 was 0.6%. If we assume an equal share of consortia members in project budgets, Czech participation would be 0.55% for both years.

For comparison, the Czech Republic contributes 1.7% to EU GDP (2022), 1.24% to EU defence spending (2021) or 1.5% to gross R&D spending (2022). A very simplistic conclusion could be drawn from this fact that Czech entities could be more ambitious in terms of participation in EDF-supported projects.

In March 2023, the Commission announced the adoption of the third EDF annual work programme. The calls were launched in June 2023, with an allocation of €1.2 billion. By the closing date for applications (November 2023), a record 236 proposals had been submitted (an increase of 76% compared to last year).

If Czech entities were able to join the European consortia, positive impacts could be estimated on the basis of multiplier effects. The transactional multiplier describes the direct and indirect effects, i.e. the initial increase in revenues and then the subsequent revenues of other suppliers along the value chains. The fiscal multiplier includes, in addition to the transactional multiplier, the induced impact due to increased household consumption (induced by increased household income based on the direct and indirect effects).

The gross value added multipliers for the NACE sectors in which successful Czech applicants are classified range from 0.61 to 1.21, household income multipliers from 0.25 to 0.63 and government income multipliers from 0.20 to 0.40.

Let us illustrate the potential effect of the EDF funds on NACE 72 - Research and Development. For this sector, the value of the output multiplier is 1.75, the gross value added multiplier is 0.89, the household income multiplier is 0.33 and the public revenue multiplier is 0.27. by which output in the NACE 72 sector rises as a result of the aid will increase output in the whole economy by CZK 1.75 million, gross value added by CZK 0.89 million, household income by CZK 0.33 million and public revenue by CZK 0.27 million. In order to get the total value of the benefits of the project under consideration, we need to multiply the relevant multiplier by the amount of funds provided by the EDF. Thus, if a NACE 72 entity received EUR 600 000 (approx. CZK 14.6 million at the end of 2023) from the EDF, this would mean an additional increase in total value added for the Czech economy of CZK 13 million (CZK 8.6 million at the end of 2023). CZK in indirect effect, CZK 3.1 million in direct effect, CZK 3.1 million in indirect effect. CZK in induced effect). The net income of households increased by CZK 4.8 million and that of public budgets by CZK 3.9 million.

Other positive impacts of the EDF for the Czech industry, if the instrument does not completely fail in meeting the set objectives, should be those anticipated by the European impact assessment for the relevant regulation, namely increased competitiveness and innovation capacity, increased economic efficiency, reduction of duplication and realisation of economies of scale, reduced dependence on suppliers outside the EU, reduction of barriers to cross-border cooperation, reduced fragmentation of demand and supply, increased cross-border involvement of SMEs and mid-market capitalisation companies in defence supply chains and the creation of cross-border partnerships, increased quality and diversity of technologies developed in the EU, promotion of technologies in areas where there is currently a lack of investment, etc.

What impact will EDF have on the Czech industry?

The amount of resources allocated to EDF is not entirely negligible. In comparative terms, the EDF budget represents 0.66% of the EU budget for the period. This is equivalent to half of the EU Space Programme, one tenth of Horizon Europe, but more than twice the size of InvestEU, the EU's flagship investment programme. The importance of EDF is confirmed by the interest and participation of major European companies (Airbus, Leonardo, Thales).

The level of transaction and fiscal multipliers varies for the different sectors of entities that have benefited from EDF support or may be other potential participants in EDF-supported projects. NACE 46, NACE 71 and NACE 74 have relatively high multipliers. However, every euro gained that can be multiplied in the Czech economy is a benefit for Czech industry.

A very simplistic comparison of the share of Czech participation in EDF-supported projects with other indicators suggests that Czech operators could be more ambitious in their spending.

Aligning with larger countries may not be so easy, however, as:

- the challenges are still dominated by large companies; this cannot be seen as a negative a priori, what is important is the way in which these companies involve other actors (see also the last two bullets of this list);

- there is still a clear regional imbalance, with several Member States having a significantly higher share (France, Italy, Germany, Spain);

- a large proportion of beneficiaries are entities well acquainted with EU funding, having been involved in other EU projects before;

- a large proportion of project participants have worked with members of their project consortium before, as building relationships with new partners from scratch is challenging (need to know the business environment in the country, gain confidence in the partner's skills and knowledge, etc.).

The EDF funds are not closed to Czech entities due to the existing participation of Czech companies. There are a large number of themes and it is hard to imagine that Czech companies would not find a place within them. However, it will first be necessary to gain the trust of potential partners and to join international consortia. At the same time, Czech entities will have to get to grips with the whole process of awarding aid and learn how to work with the EDF rules.