Slovak acquisition of tracked armoured vehicles as a prospect for the Czech tender and vice versa

The recently published "Feasibility Study for the Acquisition of Tracked Armoured Fighting Vehicles and Tracked Armoured Vehicles" in Slovakia gives a preliminary answer to the question which of the four or five types of tracked armoured vehicles the Slovak Armed Forces will choose for their mechanised brigade. As in the analogous case of the eight-wheeled armoured vehicles, it is now likely that the Slovak Ministry of Defence will notify the Government by the end of June of its intention to award a contract according to the offer that the study identifies as the most successful - in this case, the CV9030SK vehicle from the Swedish company BAE Systems. The contract will then be signed by the Slovak and Swedish Governments by the end of the year. Thus, Slovakia has reached a solution to the issue of tracked IFVs faster than the Czech Republic (we wrote about this possibility in March 2021), which has been dealing with it in the framework of a complicated and criticized tender since spring 2019, and is currently waiting for a decision on the next course of action, which will be based on the result of the recently prepared legal analysis of the tender by the Minister of Defence Jana Černochová. The question is whether the Slovak result, Slovak requirements and selection parameters are a possible inspiration for the Czech Republic.

Picture: The recently published "Feasibility Study for the Acquisition of Tracked Armoured Fighting Vehicles and Tracked Armoured Vehicles" in Slovakia provides a preliminary answer to the question of which of the four or five types of tracked armoured vehicles on offer the Slovak Armed Forces will choose for its mechanised brigade. | Ministry of Defence of the Slovak Republic

Picture: The recently published "Feasibility Study for the Acquisition of Tracked Armoured Fighting Vehicles and Tracked Armoured Vehicles" in Slovakia provides a preliminary answer to the question of which of the four or five types of tracked armoured vehicles on offer the Slovak Armed Forces will choose for its mechanised brigade. | Ministry of Defence of the Slovak Republic

Slovakia has been offered its solutions for the intergovernmental agreement by the Governments of Sweden (CV9030 and CV9035 from BAE Systems), Hungary (LYNX KF41 from Rheinmetall), Spain (ASCOD 42 from GDELS) and, at the last minute, Poland (BORSUK from PZG). In the first phase, Slovakia will buy 152 vehicles in seven variants (combat, command, reconnaissance, anti-material rifle carrier, grenade launcher squad vehicle, recovery and technical assistance vehicle), while in the second phase it will buy 71 units also in seven variants (combat, recovery, technical assistance vehicle, engineer explosive ordnance disposal, engineer mine thrower, engineer support and 120mm self-propelled mortar). In this respect, it differs somewhat from the selection in the Czech Republic, which is requesting 210 vehicles in seven variants. For the sake of comparison, let's take a look at the exact numbers of the individual variants of the tracked IFVs on demand (in the Slovak case, it is the sum of the first and second phases of the project):

| Slovakia | Czech Republic | ||

| Combat vehicle | 115 | Combat vehicle | 125 |

| Command Vehicle | 15 | Command Vehicle | 26 |

| Reconnaissance vehicle | 9 | Reconnaissance vehicle | 13 |

| Anti-material rifles carrier | 3 | – | – |

| Grenade launcher squad vehicle | 9 | – | – |

| Recovery vehicle | 13 | Recovery vehicle | 12 |

| Technical Assistance vehicle | 12 | – | – |

| Explosive Ordnance Disposal | 9 | – | – |

| Mine thrower | 9 | – | – |

| Engineer support vehicle | 9 | Engineer vehicle | 12 |

| 120mm samohybný minomet | 20 | – | – |

| – | – | Artillery reconnaissance vehicle | 11 |

| – | – | Ambulance | 11 |

| Total | 223 | 210 |

At first glance, if we ignore the specific variants for transporting soldiers with antimaterial rifles and grenade launcher squads, the Slovak list lacks ambulances and vehicles for artillery reconnaissance, and on the contrary, beyond the Czech requirement, Slovakia demands more engineer vehicles. The project also includes a self-propelled mortar on the platform of the chosen IFV - this will be the subject of a separate order in the Czech Republic, and it has not yet been decided whether it will be a vehicle with a wheeled or tracked chassis.

Just as the Slovak and Czech orders differ in the detail of the individual variants, they naturally differ in the variety of accessories, which in the Czech Republic include wheeled mobile repair vehicles, simulators, spare parts kits and much more. Comparing the total cost of the two projects can therefore be very misleading, as is always the case with large military contracts across Europe, and is complicated by the fact that the figures published by the Slovak study only cover the first phase of the project. If we admit that in general terms these are comparable projects of very related purpose, and if we know that the tactical and technical requirements for the vehicles from the side of the Czech Armed Forces and the Slovak Armed Forces do not differ in principle, because they have to comply with a common deployment doctrine, it is nevertheless not out of the question to look at the resulting price.

On the Czech side, so far we only know the aforementioned maximum allowable price, which was set many years ago at CZK 52 billion for 210 vehicles, and which the individual bidders in the tender were not allowed to exceed with their final bids (in November 2021, deemed unsatisfactory by the Ministry's expert committee).

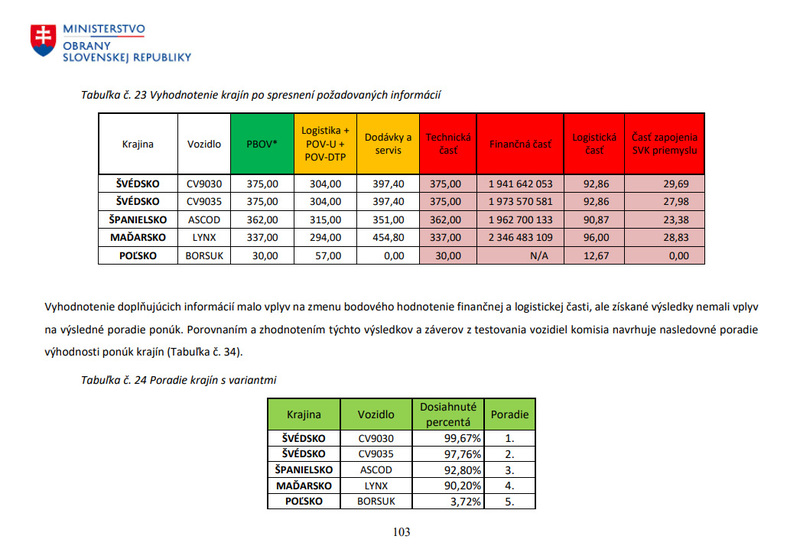

In Slovakia, thanks to the feasibility study, we know the final bid prices (including life cycle, spare parts and initial training and logistics) for 152 vehicles, which amount to €1.942 billion (CZK 48.1 billion) for CV9030SK, €1.974 billion (CZK 48.9 billion) for CV9035SK, €1.963 billion (CZK 48.6 billion) for ASCOD 42 and €2.346 billion (CZK 58.1 billion) for LYNX KF41; Borsuk was virtually eliminated because Poland did not supply all the necessary documents.

Bearing in mind that the following figure is grossly misleading in absolute value for the reasons mentioned above, one winning CV9030SK in the first phase comes out at CZK 316 million, while the Czech Ministry of Defence's original pricing envisaged a maximum price of CZK 248 million per vehicle. The Hungarian offer of LYNX KF41 vehicles in Slovakia is based on 382 million, which is more than 1.5 times the highest Czech price so far. However, the original final bids in the Czech tender are valid only until the end of June, and while we are waiting for the decision of the Ministry of Defence on the further procedure, there is speculation in the media and on social networks about the termination of the tender and the subsequent purchase of vehicles in the G2G format, and naturally according to the new terms of reference and new conditions from both sides - i.e. the newly defined requirements of the Army / Ministry of Defence, and the new offer of the supplier.

In November last year, the Slovak Ministry of Defence set the planned price at EUR 1.739 billion, and in this respect there has been an increase of around 12% in less than six months, and it can be assumed that the final real total will be even higher. What this means for the original Czech price set many years ago is quite clear. By the way, the substantially increased price for new IFVs for the Czech Armed Forces and the ways to solve this problem have also been discussed in the professional media for some time.

The "Feasibility Study" contains some interesting passages that have obvious overlap with the Czech environment in the most general terms. One of the themes that repeatedly returns to the Czech discussion is the consideration of the possible replacement of some variants (ambulance, reconnaissance and artillery reconnaissance) by wheeled platform vehicles, where the main argument is the rising prices or the unlikely maintenance of the originally set price of 52 billion crowns for 210 tracked vehicles. The Slovak feasibility study on page 22 then mentions the 8x8 wheeled chassis platform, which is the subject of a parallel acquisition in Slovakia, as the 'most likely alternative' in case the acquisition of tracked combat vehicles is not realised.

The Czech defence budget is hopefully set to grow dramatically and the cost of tracked armoured personnel carriers will certainly be spread over many years. At the same time, however, other strategic orders are also being accelerated, such as the acquisition of tanks, supersonic aircraft, the acceleration of the purchase of more Pandurs, TITUS, drones, light strike vehicles, and self-propelled mortars. Not least in response to the course of the war in Ukraine, the Army will certainly be looking at some form of reintroduction of Multiple Rocket Launcher Systems and a whole range of other projects. In other words, despite the aforementioned increase in the defence budget, perhaps to 2% of GDP as early as 2024, there will undoubtedly always a shortage of money. After all, during those years when there was seemingly plenty of time for everything in the matter of tracked IFV, or when things were complicated by the COVID, it was not only prices that were rising - technology development was also underway. So if the tender for the IFVs is cancelled and new requirements are set, it will be alchemy. It will be necessary to balance the Army's requirements and the budget's capabilities in a context that is already quite different in many ways since the spring of 2019. Let alone since the marketing survey of 2013.

The initial reaction to the Slovak feasibility study and its result, i.e. the de facto selection of the CV9030SK vehicle from BAE Systems, may be the impression that this particular vehicle was therefore objectively evaluated as the best of those on offer. First and foremost, it should be borne in mind that this is not an evaluation of the vehicle and its characteristics, but an overall evaluation of a specific comprehensive offer by the Slovak Ministry of Defence according to a set methodology. In the Slovak evaluation, compliance with the technical criteria was weighted at 30%, the logistical criteria at 10%, the level of involvement of Slovak industry at 25% and the overall price at 35%. In the Czech Republic, the tender weighting is 55 % for price, 20 % for technical parameters and 15 % for the rest, including the involvement of domestic industry. And, of course, it is possible to imagine completely different combinations, which then also give completely different results.

Picture: Results of the evaluation of the technical, financial, logistical and industrial involvement part of the Slovakian industry | Ministry of Defence of the Slovak Republic

Picture: Results of the evaluation of the technical, financial, logistical and industrial involvement part of the Slovakian industry | Ministry of Defence of the Slovak Republic

For example, in the case of the LYNX KF41, the authors of the Slovak study state that its advantage, apart from its modularity and the use of the latest technologies, is its "surplus of interior space, which provides the prerequisites for further development" and its disadvantage is the overall dimensions and silhouette of the vehicle. However, it is not clear from the details of the published study how and to what extent these advantages and disadvantages have affected the overall result of the technical part, which itself was weighted at 30%. Somewhat surprisingly, the ASCOD 42 was again criticised for the noise and vibration of the vehicle when driving on hard surfaces, a problem that has so far been mentioned almost exclusively in connection with the British AJAX vehicle on the same platform. The selected CV90 type was again blamed by the authors for not meeting some of the required parameters (gun elevation, overcoming a perpendicular trench) - and again we do not know to what extent this was reflected in the overall assessment.

The Slovak approach seems transparent, although many crucial parts are not disclosed due to the sensitivity of service or commercial information. In any case, the Slovak process was very fast. The conditions were set last spring and this spring the Slovaks have a result in hand to work with. The cumbersomeness and lengthiness of the Czech procedure probably means higher costs for the Czech Republic in the tens of billions of crowns overall. At the same time, looking at the scales by which the Slovaks chose, the Czech emphasis of 55% on price is striking. It would mean that even a relatively smaller difference in price would have a more significant impact on the final decision. This is a technology that will be used by the Army for at least two, but more likely three or four decades, and from this point of view, "a billion here, a billion there" appears to be perhaps a less crucial parameter than, for example, the potential for further modernisation and the ability to make full use of emerging technologies, or the degree and manner of involvement of domestic industry in the contract.